Hello Investing Friend!!

I hope you are doing well. If not, I bring news of big things happening the market and the economy.

And meme stock madness is in the balance.

Let’s dive in!!

We’ll start with the background and then get to the big stock plays.

Tether is a Big Deal

You may have heard of Tether – but do you know what it is?

Tether’s USDT is the largest stablecoin in the world, pegged 1:1 to the U.S. dollar. It is issued by Tether Limited, which is linked to Bitfinex.

Tether is basically an alternative to traditional banking – with strong advantages.

Users get to hold, receive, or send digital dollars, without even having a bank account. When transactions are done on the Lightning network they are super-duper cheap (like less than a penny), near instant, and cross any border.

And the US government is not shutting this party down. It now loves Tether.

Tether backs its digital dollars with Treasuries, so as Tether becomes more popular it funnels more and more money into Treasuries. At the end of 2024 it had $113B of US Treasuries. Compare that to China’s $767B accumulated over many years, and Tether is quickly becoming important to funding the US government.

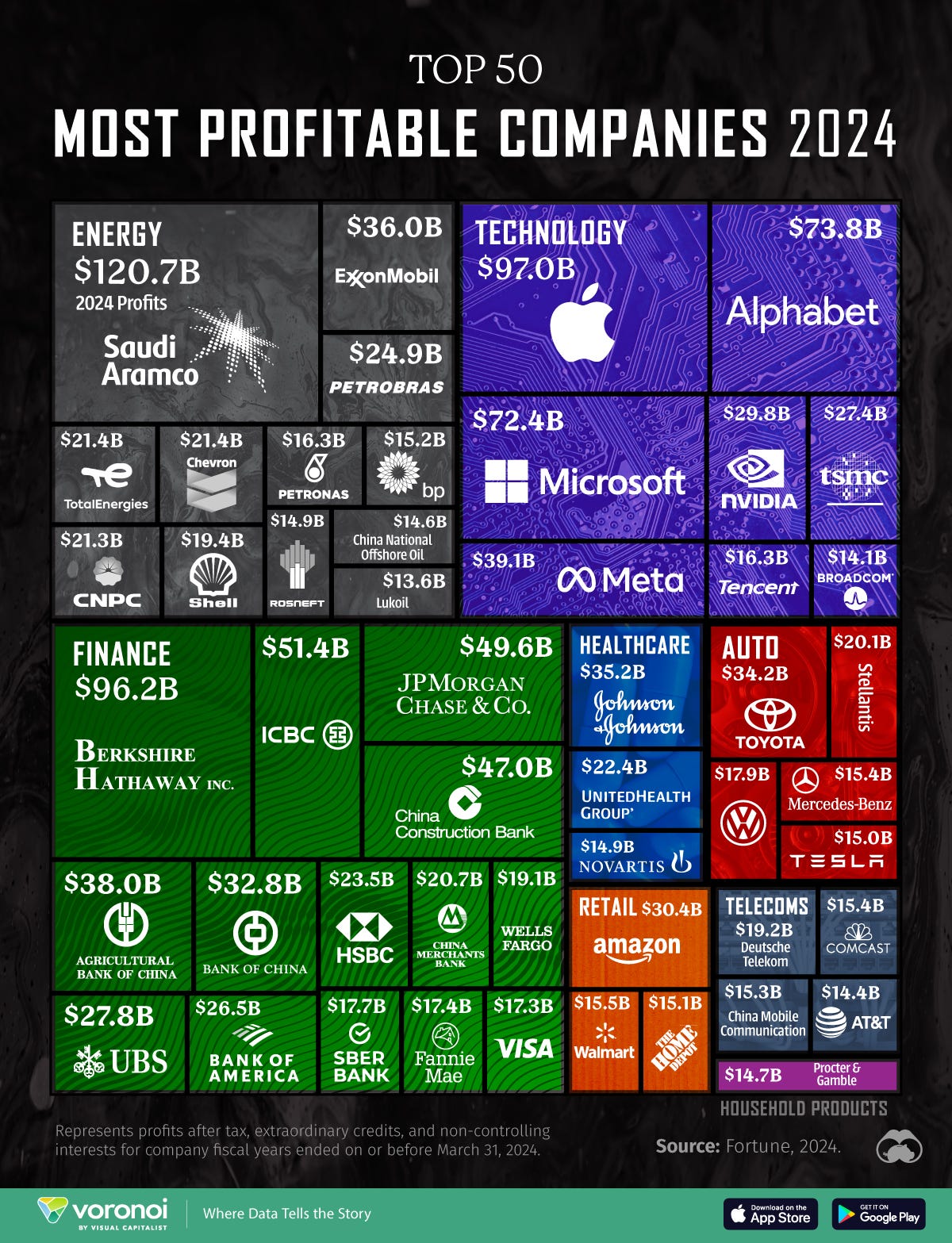

And perhaps more importantly – Tether earned a whopping $13B in profits in 2024. It is fast joining the ranks of the most profitable companies in the world – and it is just getting started.

There should be many players salivating to get in the game.

So, here we have an exploding technology that is set to disrupt / already disrupting banking and payments like crazy – and with government support.

The government love affair has yielded some policy changes. Notably, the President issued the executive order Strengthening American Leadership in Digital Financial Technology and the SEC rescinded SAB 121.

Trump wanted to position the United States as a leader in digital financial technology. These are impactful moves, opening up development nearly across the board. Perhaps the biggest impacts are the bolstering of stablecoins and the prohibition of a Central Bank Digital Currency.

Prohibiting the CBDC bolsters stablecoins again, and points to their major role going forward.

The Mighty Look Set to Fall

Visa and Mastercard have been two of the best businesses the world has ever seen – but they are in big trouble now.

A super-fast, super-cheap, borderless payment technology looks set to eat their lunch. Visa did $16T in transactions last year…Tether is already up to $10T.

We think they will have to get in the game themselves – and aggressively. And that still likely will only partly defray the losses.

Likewise the banks and brokers will have to get into the game aggressively – or get run over.

These look set to lose their rehypothecation scheme, wherein they loan out stock investors shares for a fee – largely unknown to the shareholders.

That is because it is not just US dollars that can be tokenized, but anything – including stocks. So we may not be far from the world where we can own our own shares of stock, without even having a brokerage account, and with no ability for the middle men to do their shorting schemes.

Bad news for the old guard, major changes are coming at long last.

The Winners