The Most Interesting AI Play in the Best Area is Astonishingly Overlooked

There is a reason for that, and it is a big fat opportunity

Hello Investing Friend,

I hope you are well!!

If not, take heart – I have something special for us today!!

There seems to be an area of the market that is a screaming opportunity.

And within that screaming area, there is a an especially loudly shrieking stock, crying out for investor love.

We found this stock because two weeks ago, we noted that illiquidity can help predict successful R&D.

We then screened our “possible outperformers” portfolio from over 200 down to the 11 most illiquid with the highest commitment to R&D.

One of those founder-led companies was Acorn Energy (ACFN), which immediately surged, and is now approaching a double after just two weeks:

Acorn is a play on wireless remote monitoring and control systems for power equipment, amongst other things.

And by the way, last week we talked about “bull flags”. Well, by bull flag theory, you can plant another $9 flag on the $25 soil, and Acorn is $34-bound:

But, Acorn got me thinking about other stocks ready to pop in this power-tech area.

And that led me to what looks like one of the most interesting areas of the market: AI/data/robotics plays in the hated oil & gas space.

Both AI/data/robotics and oil & gas may be set up for a killer decade.

If we do it right, we could have two hurricane force winds at our backs.

We will speak in a moment about why the two areas are so interesting.

But first, let’s note that these stocks are down over the last year. Here are the averages for the sixteen stocks we identified that fit the bill:

Contrast that with our agentic AI portfolio, which is up 69.1% over the same period.

So it seems we have an entry point for what could turn out to be the very best performing tech area of all, based on those twin tailwinds.

Of course, AI/data/robotics by itself could have an all-timer of a huge future:

AI could be the most disruptive technology ever, including never-before-seen gains in productivity

The synergistic intersection of AI, data, and robotics could add $15.7T to 2030 global GDP

Governments (and firms larger than some governments) are investing heavily, with AI seen as unequaled in both opportunity and threat

It is still so early, our robot friends are not here quite yet

And oil & gas is getting more interesting by the day:

Those super-huge gains in productivity and GDP will burn through truly huge amounts of energy

With the US budget requiring bountiful inflation to “inflate away the debt”, dollar-denominated commodities could go up by standing still as the dollar gets debased. Oil was a terrific play in the 1970s and may be here again.

With 3B+ people consuming below the modern energy minimum, there are billions of people ready to enter the energy-hungry middle class

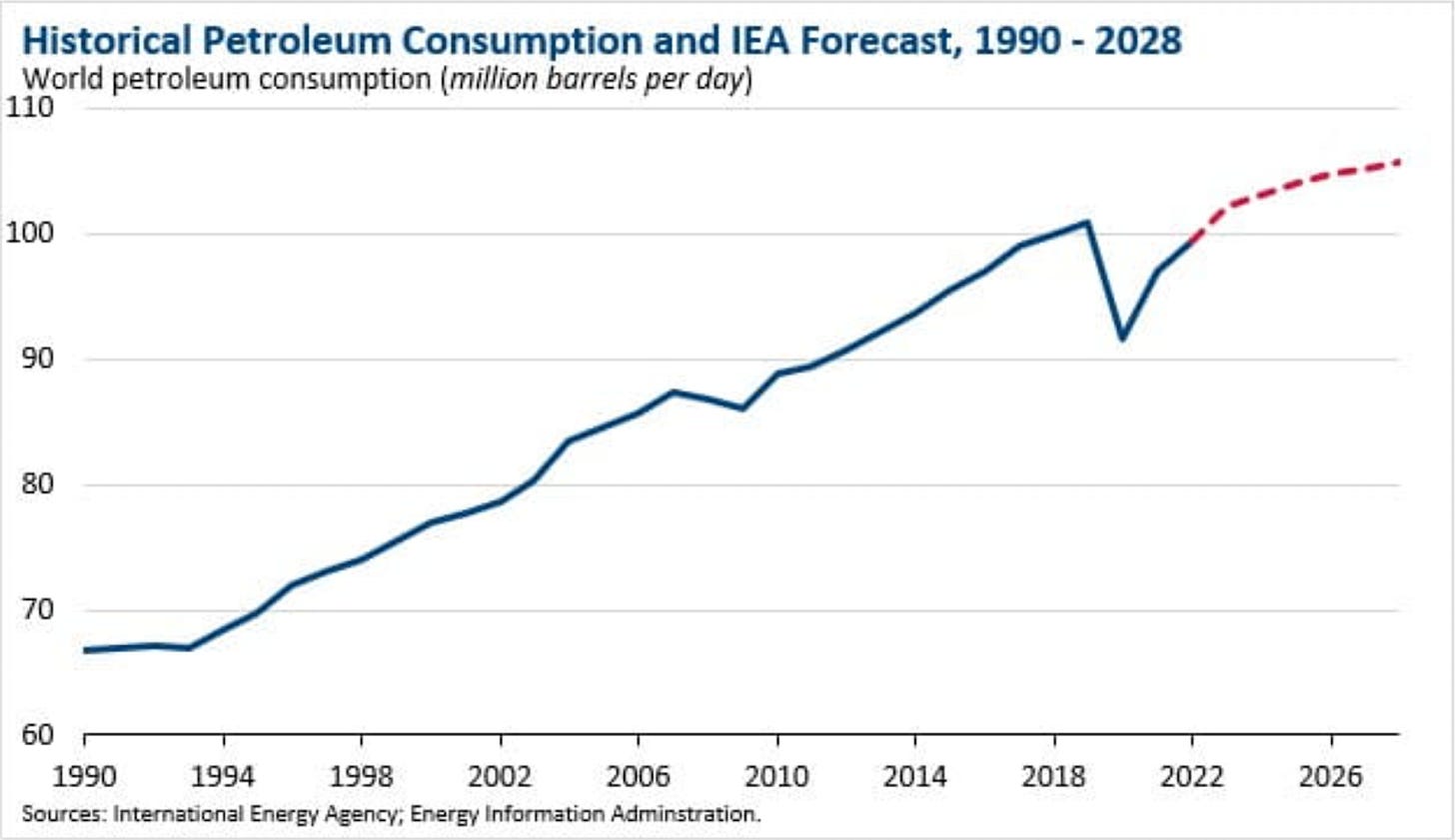

For all the talk of renewables, petroleum consumption is projected to keep expanding:

And lastly, oil prices are cyclical, and have fallen to seemingly reasonable levels – sporting the same price as the highs of 20 years ago (not adjusted for inflation):

So we went searching far, wide, and deep in the deepwater depths for the best AI/data/robotics plays focused on oil & gas.

We have sixteen plays across six categories:

Automation and Robotics – Land-Based

Automation and Robotics – Land and Offshore

Automation and Robotics – Subsea and Offshore

Data, Software, and Seismic

Drilling and Completion

Oilfield Services

With one of these stocks in particular being incredibly interesting to us.

We think you may agree.

First, here is the spreadsheet with…