The Three Stocks to Get You to $1 Billion

Hello Investing Friend!!

I hope you are well!!

If not, I have news so amazing it is akin to stumbling upon a genie in a magic lamp!!

So play along if you will, and imagine you have a genie that will grant you one of the following:

One million dollars compounded at 10% annual returns, or

$10,000 compounded at 25% annually

The catch is you have three seconds to decide, or lose both. Pick one!

Which did you pick? 100X the principle, or 1.5X the rate of return?

Let’s see which one would have been better:

After an entire decade, $10K compounded at 25% is still not even $100k, so what is the point?

Meantime, the $1M is sitting pretty at more than $2.5M. We totally should have gone for the higher principle. But let’s keep watching what happens anyway.

After two decades, the $10K is not even a $1M yet. Whereas the $1M starter is doing great – more than $6M.

But a funny thing happens after three decades. The lower principle seems to be gaining at an alarming rate, almost halfway to the higher principle.

By the 37th year, the $10K is now beating the $1M.

And after just 52 years the $10K is now over $1B, which seemed to happen super fast.

It takes a full 73 years for the $1M to become $1B. And how is the $10K doing by then? More than $100B. It’s not a fight – it's an execution!

By year 83, the 10K is now more than $1T – with the $1M having less than ⅓ of 1% of that amount.

Rate of return thumps principle. You don’t need much money to start – as long as you have a high rate of return, you can catch Warren Buffett.

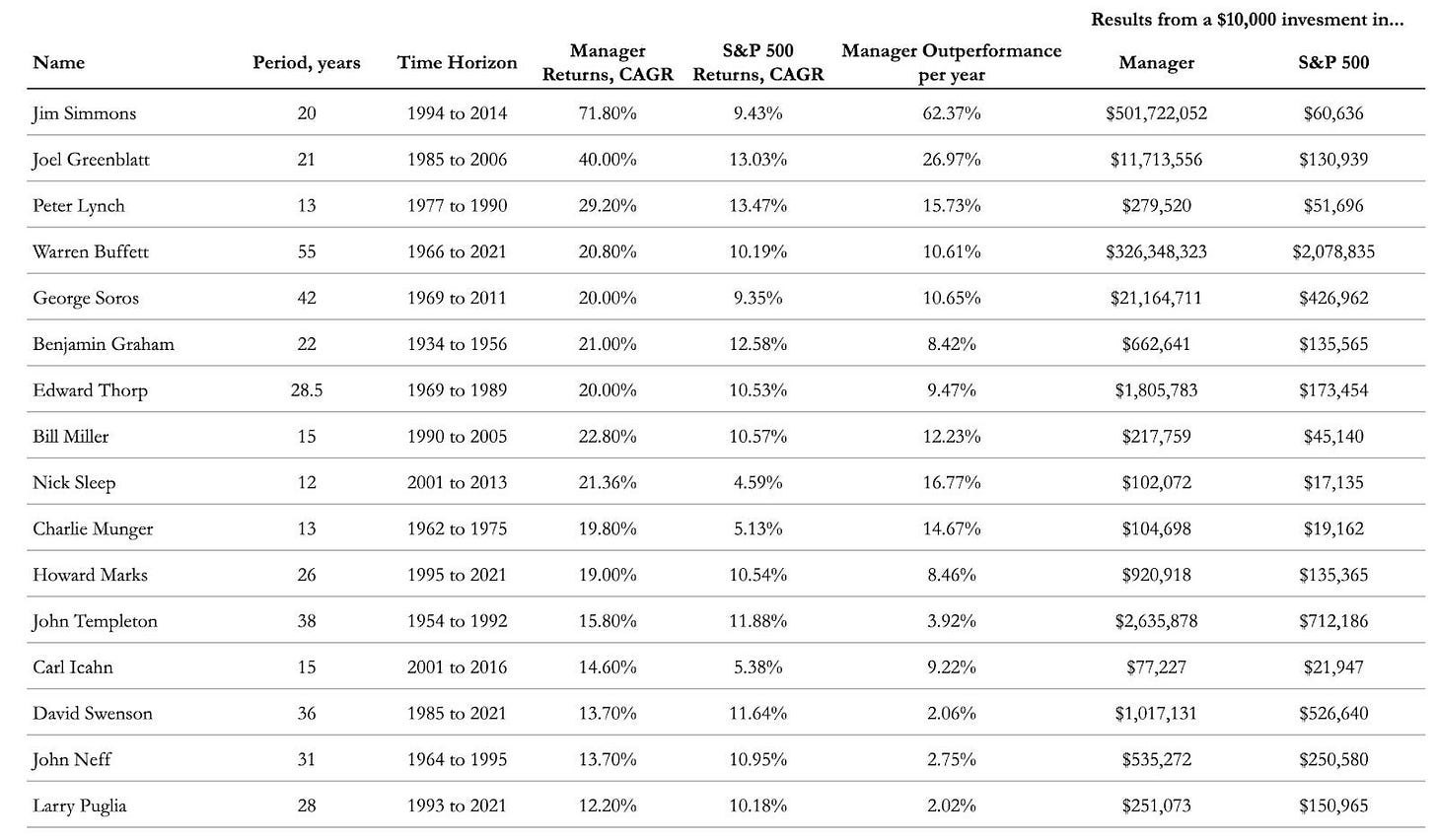

We’ve been speaking about this idea of aiming for above 15% returns, and that it is possible over the long term:

And maybe even a little better than that is doable too:

This is an exciting notion, and has people asking where to get these fabulous returns.

And so, we have started a real money portfolio, in pursuit of 20% or better long term compounding genie-like returns. The 20 / 20 Portfolio.

Why 20 / 20?

One of the 20’s is for 20%+ compounded returns, of course.

The other 20 harkens back to some sage advice from Mr. Buffett:

“You only have an opinion on a few things. In fact, I've told students if when they got out of school, they got a punch card with 20 punches on it, and that's all the investment decisions they got to make in their entire life, they would get very rich because they would think very hard about each one."

Love it. Only our best ideas. Nothing else.

This approach has a number of benefits:

Deep understanding – We can’t know a thousand topics as well as we know a few

Have to pick winners – We can’t afford risky stuff with just 20 punches

Long term compounding approach – With 20 lifetime punches, we have to focus on the long term, which is actually an edge in a market of short-termers

Minimize frictional costs – Few trading fees and micro-losses getting in and out of positions

More capital for our very best ideas

No impulsiveness – Every move must be well thought out

Ownership mentality – Buffett counsels us to think like business owners, this mandates it

Reinforces patience

Simplifies decision making – Few decisions make for best decisions, reducing biases and errors

And so we are setting out to make $1B with just 20 stocks over our lifetime.

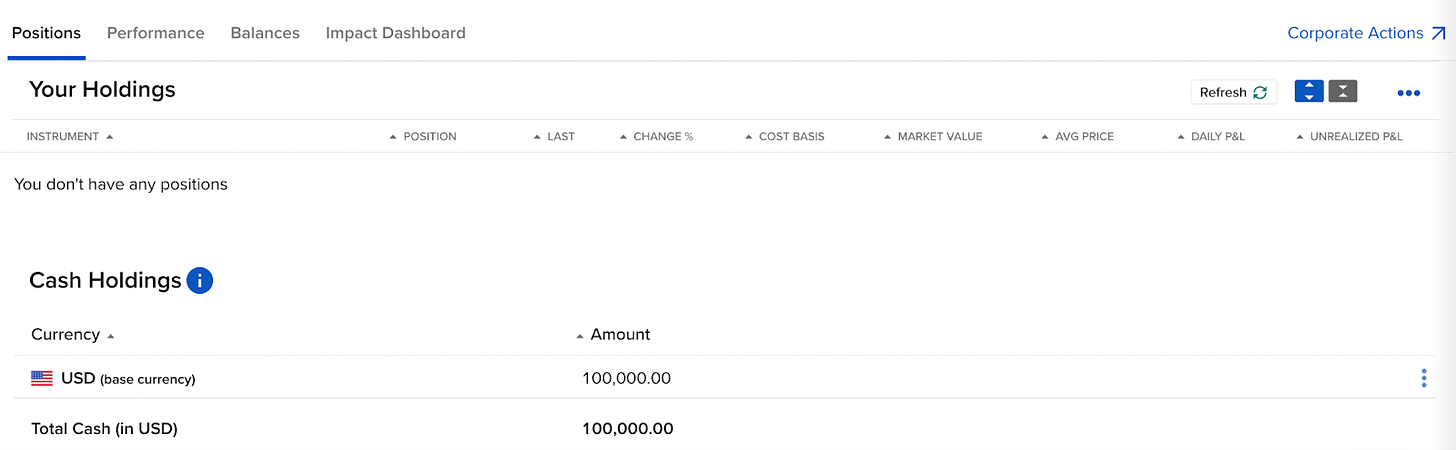

We will set $100k aside in a Roth IRA, and commence 20 / 20 compounding goodness!

This could be a tough time to get in the market, but it is also risky to sit on the sidelines. And there are three stocks we love here.

So how long does it take to turn $100k into $1B, anyway?

It takes 51 years compounded at 20% annually.

So we will make two official goals for this portfolio. One is to billionize in less than half a century.

The other goal is to beat the snot out of the S&P 500, which we screenshot right after we took our positions:

And with that, let’s pick the best compounding stock opportunities in the market!

We will send another email about all the stocks that are in consideration, we have 19 on the short list, and 23 more on the next tier down.

But in the end there were three that we could not remove from our list, no matter how much scrutiny we put on them.

Ladies and gentleman, heads of state, members of parliament, your holiness – I give you the first three punches on our 20 punch ticket!

We will do this alphabetically as we have allocated equally to show equal appreciation.