This Serial Acquirer Has a Multiplier

And has been cut in half..

Hello Investing Friend!!

I hope you are doing well!!

If not, today we have an exciting idea, that multiplies another exciting idea.

The first idea is serially acquiring businesses, growing them and making them better, and never selling.

If you never re-sell a business you buy, then founders can sell you their baby that they have been working on for so long. They know it has a forever home, and clients, employees, and legacy are cared for.

Thus, Warren Buffett has been able to be the preferred buyer – without paying more than others – in so many of the businesses he has bought for Berkshire Hathaway.

Likewise, Mark Leonard at Constellation Software. Both Warren and Mark advertise loudly that they never re-sell, and thus they get awarded a lot of deals by founders that care about their companies.

Buying and never selling is a great strategy.

BUT.

What about having expertise in an area, and acquiring companies not with an eye toward forever ownership, but with an eye toward making them better businesses. Then selling them, and doing it again somewhere else.

That is also an interesting strategy. And there is an interesting extra wrinkle here, one that multiplies the benefits of the serially acquirer strategy.

If you do a good job of making the companies you buy better, and they are now making more earnings, you can sell them for more money.

But it’s not just the higher earnings multiplied by the same old buyout multiple.

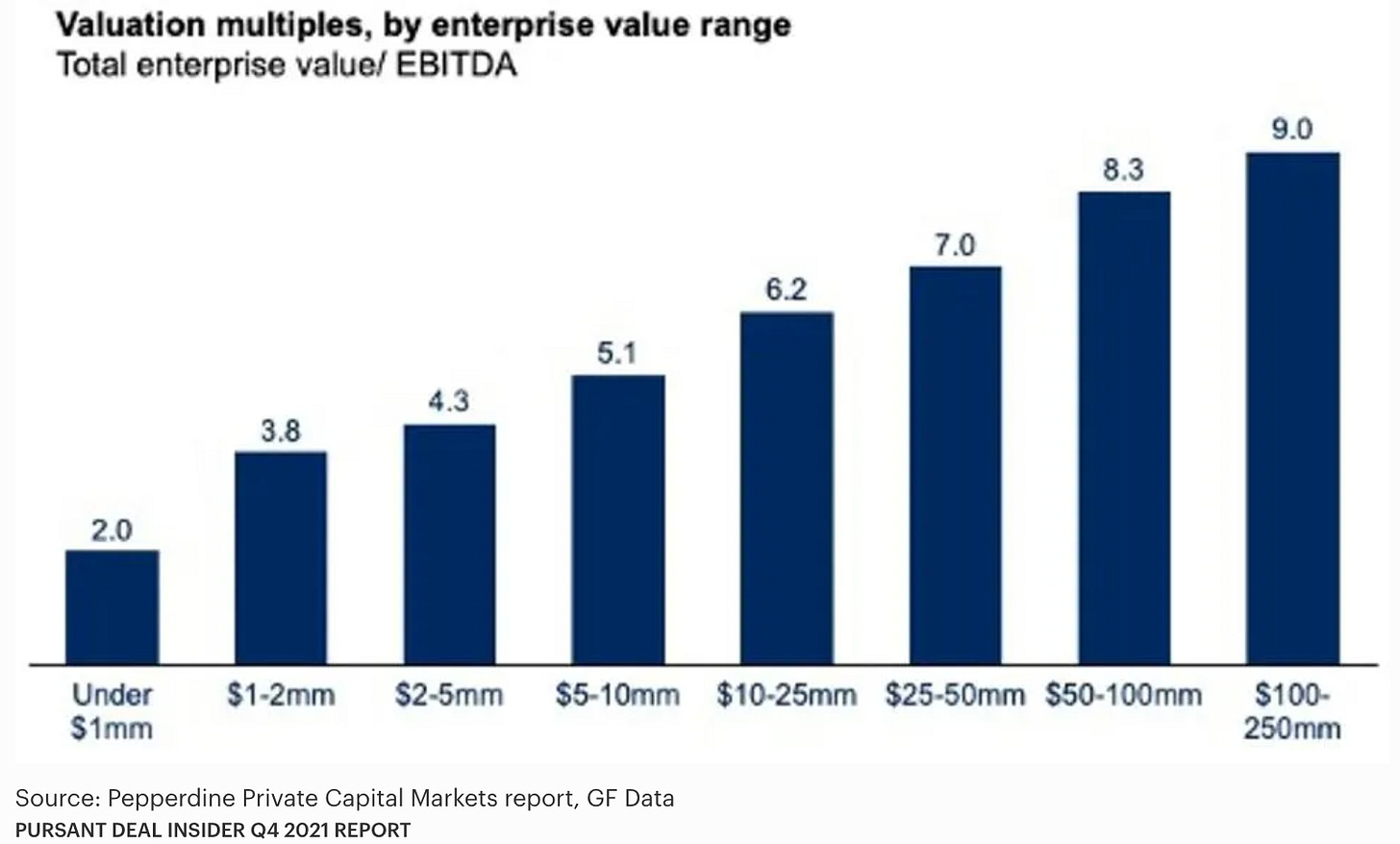

As earnings increase, buyout multiples do, too (enterprise value / EBITDA is similar to PE multiple):

To take an extreme example, we could buy a company with $1M in earnings for the sticker price of $2M.

If we then worked those earnings up to $100M, we could then sell the company not for $200M – but for $900M!!

Multiplying our winnings by 4.5 is eye-opening.

We like this buy-improve-flip model.

But why do the multiples go up like that as earnings rise?

There seems to be seven main reasons:

Less perceived risk in larger firms

Access to more buyers – rich people and institutions can’t take meaningful positions in small stuff, but as things get larger more and more join the bidding

Larger firms can access capital cheaper, which is valuable

Higher quality systems and operations in larger firms

Larger companies can serve as a “base” or platform for more acquisitions in the same area, which is valuable

Fixed cost of diligence – the fees spent doing due diligence before a buy are similar whether company earns $1M or $100M, so fees add up on small deals

As companies get larger they are comparable to public peers, and if they IPO they join the ranks of being valued publicly, leading to private and public market multiples converging

And so, we have a great one here today, taking advantage of this wonderfulness.

It is a buy-improve-flip software serial acquirer with all the goodies:

Insiders with expertise, a great record, and huge holdings

It is trading cheaply

With a margin of safety

Has significant healthcare software exposure, which is due for a long bull run

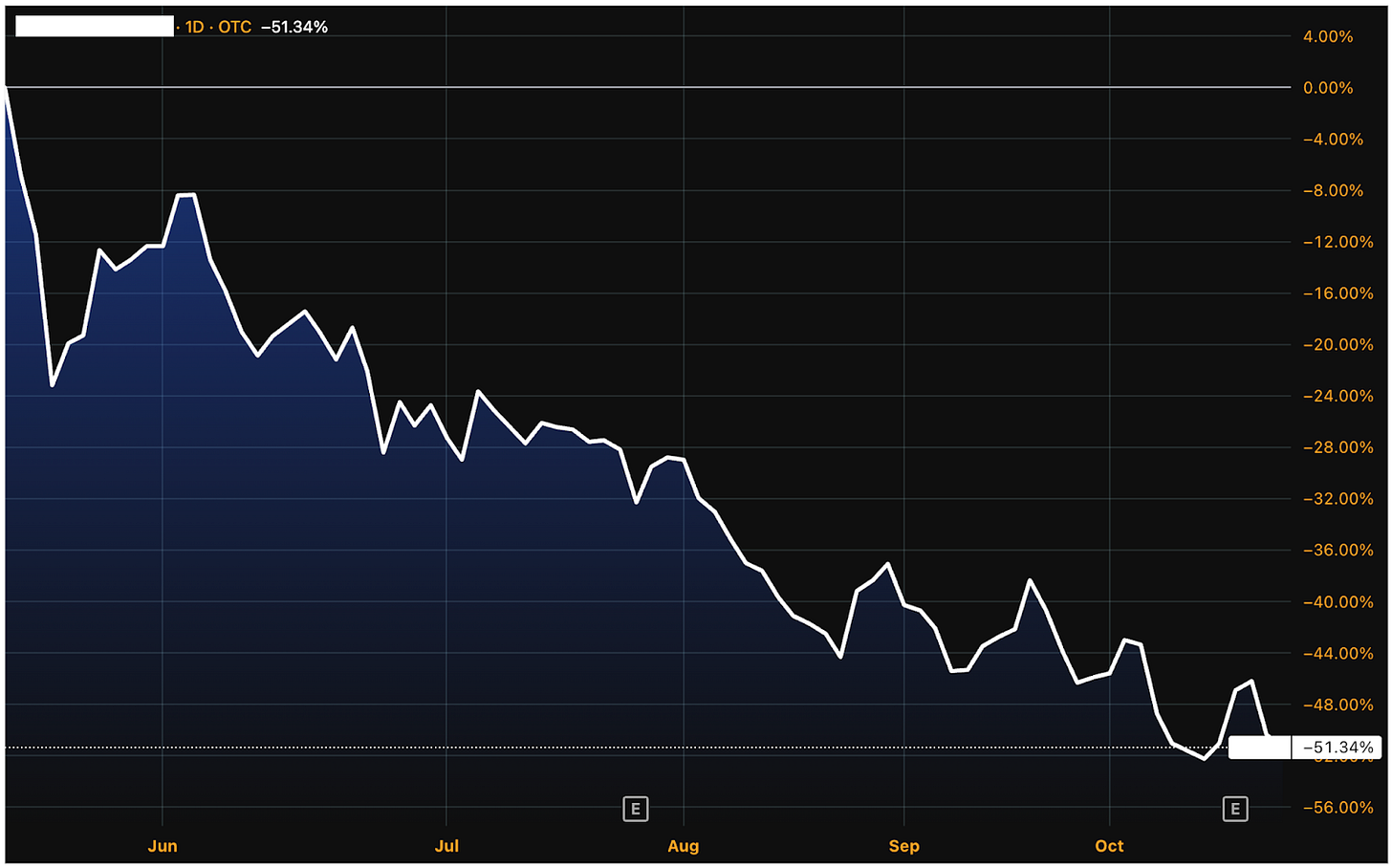

And has been brutally crushed lately

Here is healthcare tech, which is a lot of software:

And here is our hero today:

The stock is…